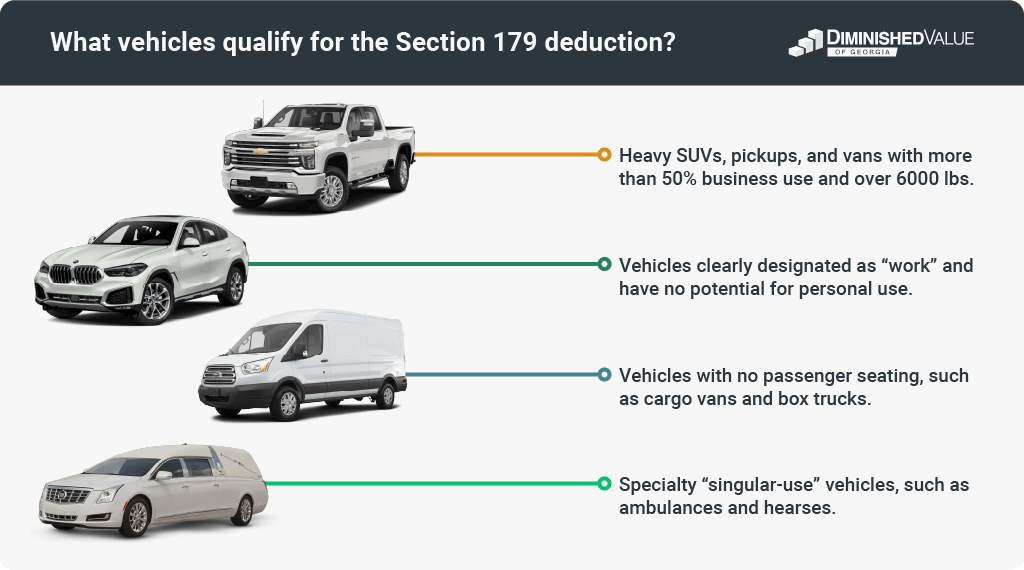

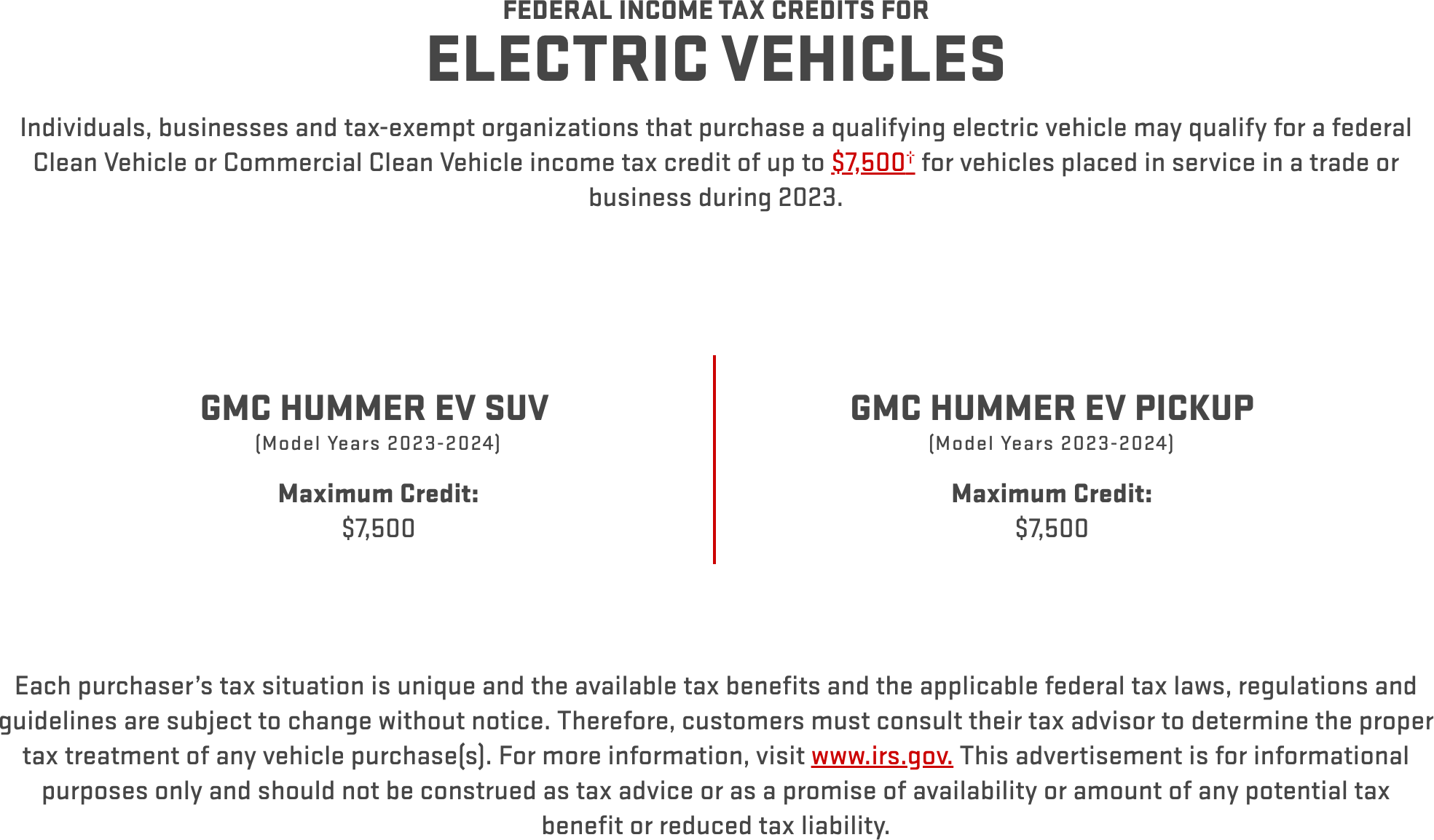

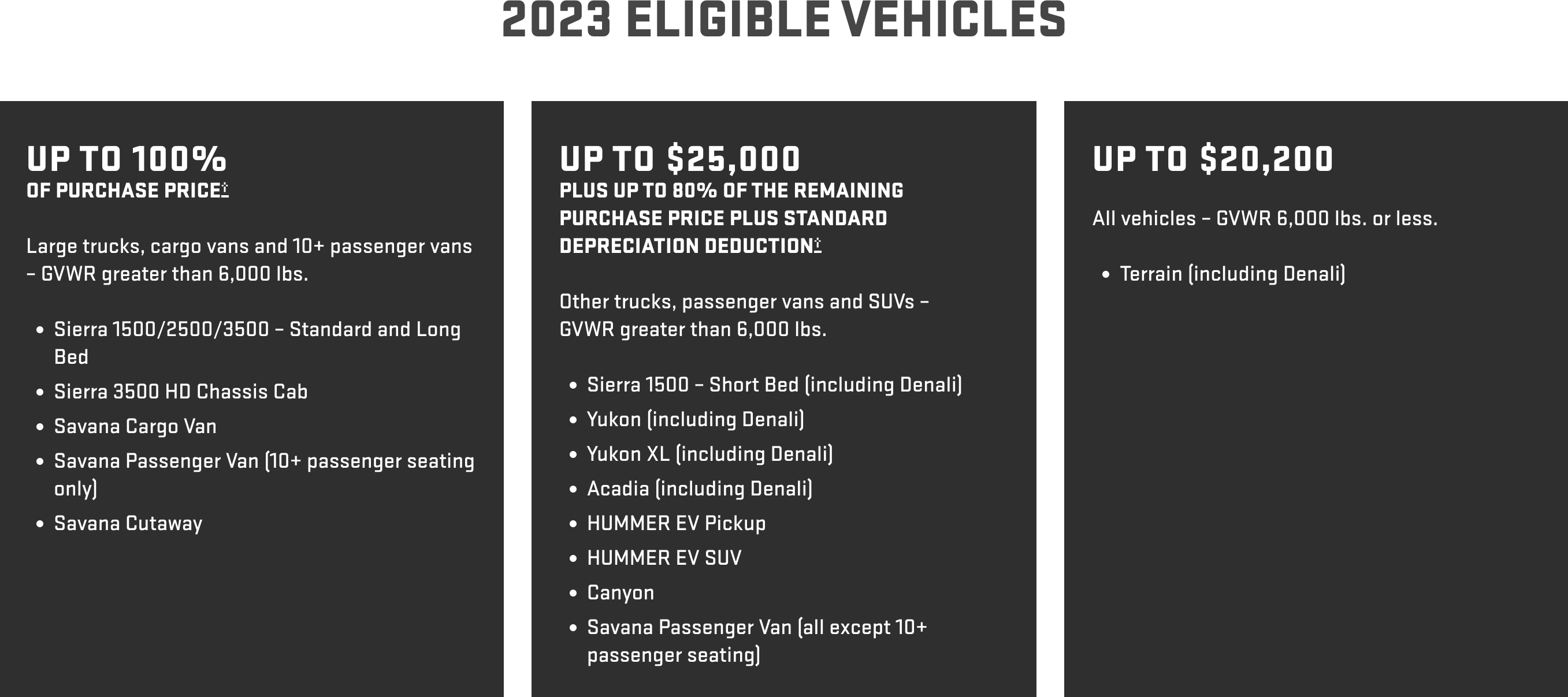

Vehicle 179 Deduction 2025 – Section 179 has been referred to as the “SUV tax loophole” or “Hummer deduction” because it was often used to write off the purchase of qualifying vehicles. The positive impact of Section . precious few vehicles qualify for a total deduction — if your heavy truck is at all practical for normal daily use, it probably doesn’t count. From Section179.org: Business Vehicles for Full Section .

Vehicle 179 Deduction 2025 Section 179 Deduction – Section179.Org: The deduction on such vehicles was capped following controversy over some business owners essentially buying luxury vehicles for personal use and writing off the full cost under section 179. . That’s where the Section 179 deduction is reported want to contend he’s a $270,000 entrepreneur who bought a vehicle which is unrelated to operating a bakery and that his only real .