Supplemental Tax Rate 2025 California. As a result, california is experiencing an additional 0.3% in their futa credit. What is the deadline for filing california state taxes in 2025?

Quickly figure your 2025 tax by entering your filing status and income. The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal.

kern county tax collector address Heide Benavidez, California annual bonus tax calculator 2025, use icalculator™ us to instantly calculate your salary increase in 2025 with the latest california tax tables. As a result, california is experiencing an additional 0.3% in their futa credit.

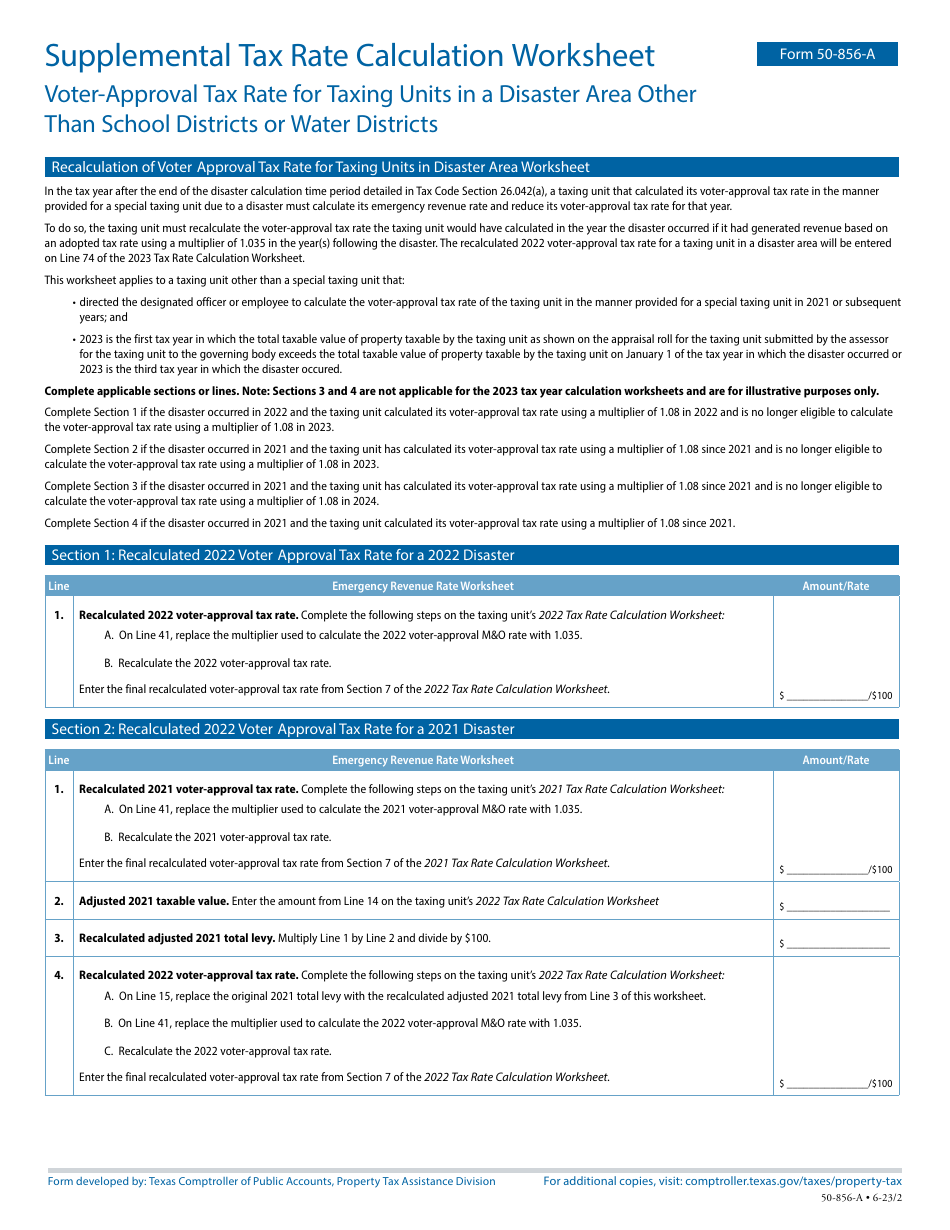

Supplemental Tax Rates By State When to Use Them & Examples, The amount of the supplemental tax and the date on which the taxes will become delinquent. This california bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Form 50856A Download Fillable PDF or Fill Online Supplemental Tax, This page has the latest california brackets and tax rates, plus a california income tax calculator. The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal.

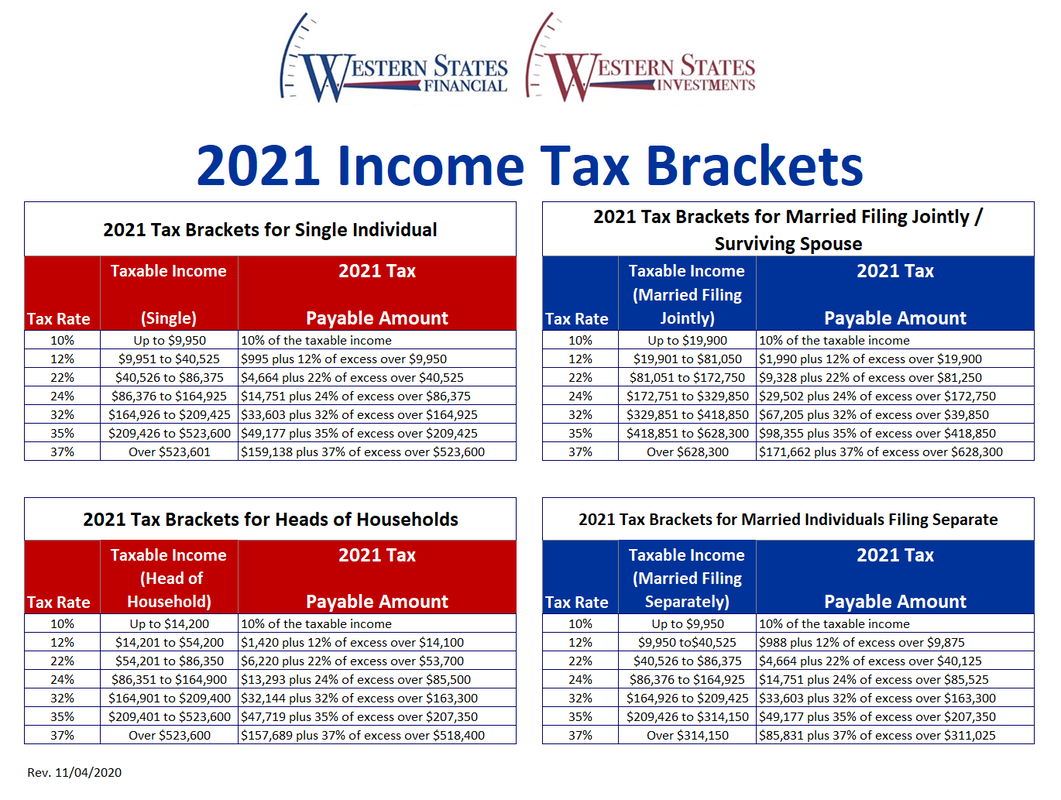

Federal Supplemental Tax Rate 2025 Federal Withholding Tables 2025, Quickly figure your 2025 tax by entering your filing status and income. Your tax rate and tax bracket depend on your taxable.

Why did I get a supplemental tax bill? California supplemental taxes, A special summary of key new. Net supplemental assessment minus homeowners' exemption times the tax rate times the proration factor for january = supplemental tax due:

Federal Supplemental Tax Rate 2025 Federal Withholding Tables 2025, Recognize that bonuses are considered supplemental income by the irs and are often taxed at a different rate than regular. However, between january 2017 and january 2025, the state sales tax rate was 6% while the average local tax rate was 1.25%, bringing the average sales tax rate.

Tax rates for the 2025 year of assessment Just One Lap, As a result, california is experiencing an additional 0.3% in their futa credit. However, between january 2017 and january 2025, the state sales tax rate was 6% while the average local tax rate was 1.25%, bringing the average sales tax rate.

Supplemental Secured Property Tax Bill Los Angeles County Property, California's 2025 income tax ranges from 1% to 13.3%. For tech employees located in california, understanding the rsu tax rate in california is a crucial piece of the puzzle, too.

Understanding Supplemental Wages and Tax Rates Justworks, Futa tax credit, resulting in the state losing a portion of the futa credit retroactively for 2025. As a result, california is experiencing an additional 0.3% in their futa credit.

Paiement des cotisations de sécurité sociale sur les revenus après l, Futa tax credit, resulting in the state losing a portion of the futa credit retroactively for 2025. As a result, california is experiencing an additional 0.3% in their futa credit.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

There are two different supplemental withholding rates that can apply, depending upon the amount of supplemental wages.

California annual bonus tax calculator 2025, use icalculator™ us to instantly calculate your salary increase in 2025 with the latest california tax tables.

What Is Business Mileage Rate For 2025. This makes calculating business mileage fairly simple. 17 rows 2025 mileage rates. The…

Minimumloon 2025 Per Uur Parttime. Sinds 1 januari 2025 is de werkgever volgens de wet verplicht om werknemers per uur…

Us Open 2025 Earnings. Open championship at pinehurst resort & c.c. The official site of the 2025 us open tennis…