Roth Ira Limits 2025. Whether you can contribute the full amount to a roth ira depends on your income. If you’re 50 or older, you can contribute even more—up to $8,000 in 2025.

If you are under age 50, you may contribute $7,000 a year. Learn the roth ira contribution limits for 2025 and 2025, and roth ira income limits here.

2025 Roth Ira Contribution Limits Catch Up Averil Ferdinanda, But as we touched on above, your income may limit whether you can contribute to a.

Roth Ira Contribution Limits 2025 Irs Bibi Victoria, The roth ira contribution limit for 2025 is $7,000, or $8,000 if you’re 50 or older.

2025 Roth Ira Limits Increase Risa Raynell, You can leave amounts in your roth ira as long as you live.

What Is The 2025 Roth Ira Limit Melly Sonnnie, For the 2025 tax season, standard roth ira contribution limits increased from last year, with a $7,000 limit for individuals.

2025 Roth Ira Contribution Limits Tax Meryl Suellen, The account or annuity must be designated as a roth ira when it is set up.

2025 Roth Ira Limits 2025 Calculator Gabie Jocelyn, The account or annuity must be designated as a roth ira when it is set up.

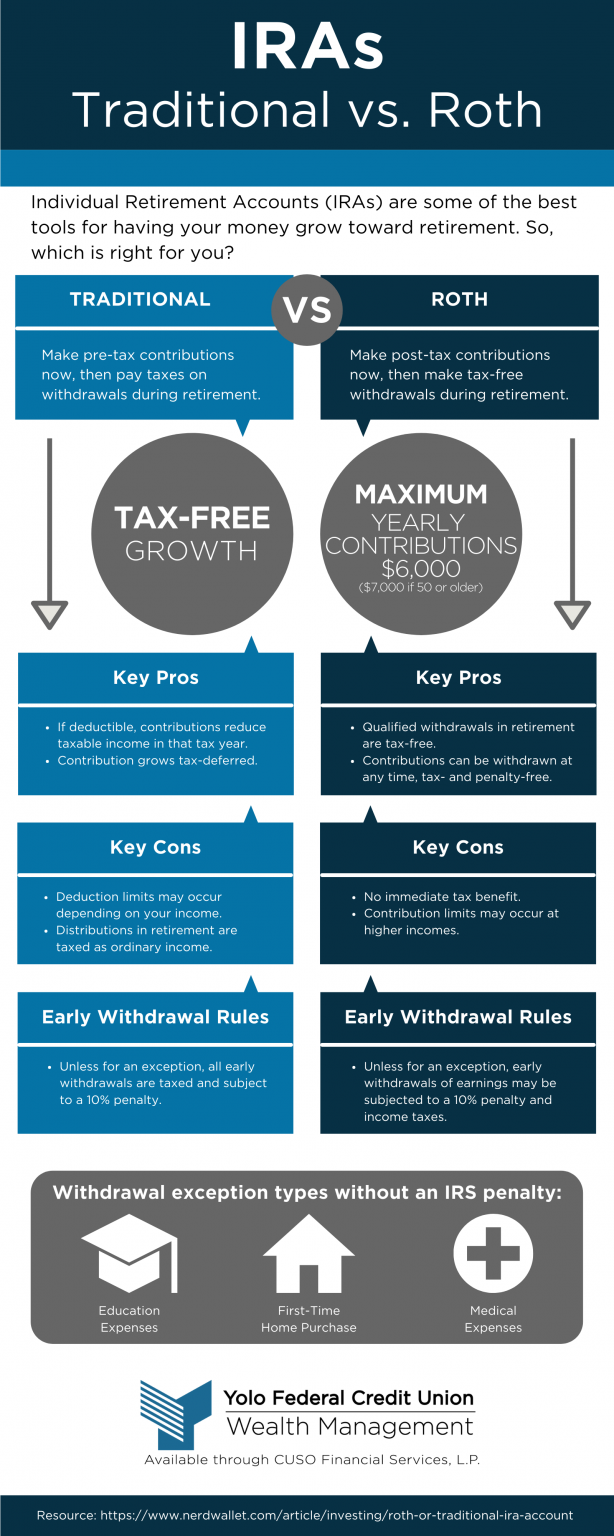

Roth Ira Contribution 2025 Over 50 Ettie, If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras is the same: